Settlement Procedure

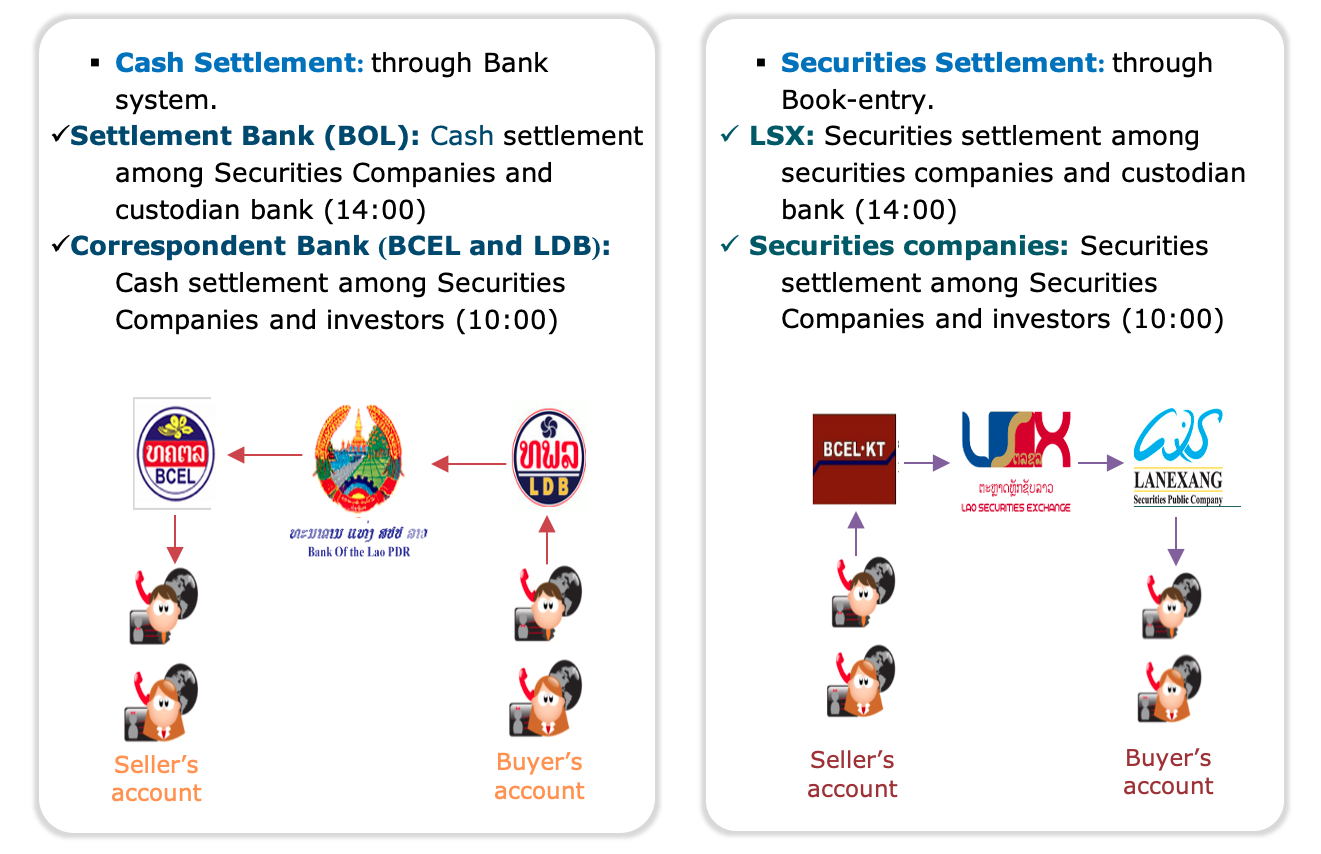

- There are two types of settlement such as cash and securities

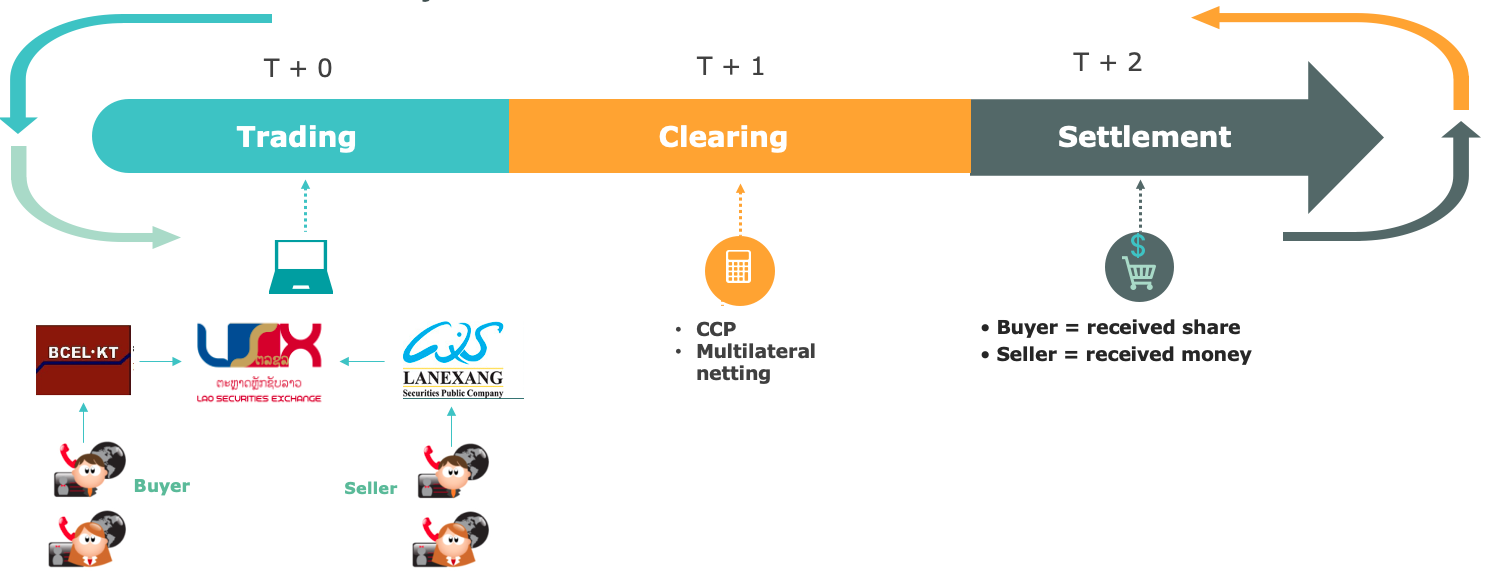

- Settlement life cycle

The settlement cycle in the trading of shares is 2 business days after the trading day. This means that the investors who buy the shares today shall receive the shares in the next 2 business days, while the investors who sell the shares today shall receive money and can withdraw such money in the next 2 business days.

- Procedure of withdrawing money from aggregate accounts

Money from selling securities and dividend payment shall be deposited in the aggregate accounts (bank account opened by securities companies for investors). Money in these accounts is free of interest. In order to withdraw money, such money shall be transferred to investors’ personal bank accounts.

Investors, who wish to withdraw their money that receive from selling shares or dividend payment, can withdraw such money by following steps:- Step 1:

- Check your cash balance (proceeds from sale or dividend) with the securities company that you have opened securities trading accounts with or you can check online by yourself through the Home Trading System (if you already have applied).

- Step 2:

- There are optional methods to withdraw money:

(1) Instruct a securities company via phone call, e-mail and fax to transfer money from the agregate account to your personal bank account;

(2) You can proceed transferring money by yourself visiting the head office or branch of correstpondent bank;

(3) Use online application of correstpondent bank to transfer money by yourself any time no matters even off working hours (for instance i-Baking or LDB wallet and tec.)

(4) When money alredy in your personal bank account, you can normally withdraw from ATM or other means.

- There are optional methods to withdraw money:

- Remark:

- For more information contact your securities company.

- Government Bond Principal and Interest Payment Method

- Method for Interest Payment 1 Time/Year

- Interest = Bond Value x Coupon Rate

- Method for Interest Payment 2 Times/Year

-

Interest Payment = Bond Value x Coupon Rate x (Actual Days of Payment

Installment / Actual Days of Payment in one Year Period) - Example:

- Bond Value: 1,000,000 Kip

- Coupon Rate: 5% per Year

- Issue Term: 1 Year

- Case No.1: Number of Interest Payments Per Year = 1, The Bond Interest Payment Calculation Method is as follows:

- Interest = 1,000,000 Kip x 5% = 50,000 Kip

- Principal and Interest = 1,050,000 Kip

Started Date of the payment period for the calculation Last Date of the

payment period for the calculationPayment Date Actual Days of Payment in the Period (Days) Interest Installment 05/09/2019 04/09/2020 05/09/2020 366 1st Installment - Case No.2: Number of Interest Payments Per Year = 2, The Bond Interest Payment Calculation Method is as follows:

- ♦ The Calculation of the Government of Bond Interest Payment, which paid twice a year shall use the "Actual Days of Payment" for the calculation, which according to the Bond Prospectus with the following details:

Started Date of the payment period for the calculation Last Date of the

payment period for the calculationPayment Date Actual Days of Payment in the Period (Days) Interest Installment 05/09/2019 04/03/2020 05/03/2020 182 1st Installment 05/03/2019 04/09/2020 05/09/2020 184 2nd Installment - Remark:

- - In the example the Actual Days of Payment in one Year Period is 366 days.

- - On 05/09/2019 is The Government Bond Registered date and the Starting Date used for the interest payment calculation according to the prospectus.

- 1) 1st Interest Payment Installment.

-

Interest Payment = Bond Value x Coupon Rate x (Actual Days of Payment in the 1st

Installment / Actual Days of Payment in one Year period) - 2) 2nd Interest Payment Installment.

-

Interest Payment = Bond Value x Coupon Rate x (Actual Days of Payment in the 2nd

Installment / Actual Days of Payment in one Year period)

1st Interest Payment Installment = 1,000,000 Kip x 5% x (182 Days / 366 Days) = 24,863.39 Kip 2nd Interest Payment Installment = 1,000,000 Kip x 5% x (184 Days / 366 Days) = 25,136.61 Kip Principal and Interest = 1,025,136.61 Kip - Step 1: